January to February 17, 1969

NEMS / Nemperor is sold to Triumph Investment Trust

Last updated on January 8, 2025

January to February 17, 1969

Last updated on January 8, 2025

Article Feb 12, 1969 • Adagrose Ltd is created

Article Feb 13, 1969 • Launch party for Mary Hopkin’s album "Post Card"

Article January to February 17, 1969 • NEMS / Nemperor is sold to Triumph Investment Trust

Album Feb 17, 1969 • "James Taylor (Stereo)" by James Taylor released in the US

Session February 18 or 19 or 20 or 21, 1969 • Recording "Don't Let Me Down" ?

Next article February 21 to August 1969 • The Beatles fight for NEMS / Nemperor

Fall 1968 • Apple faces business problems

January 1969 • Apple's business problems become public knowledge

Jan 12, 1969 • The Beatles meet together to discuss their personal and business problems

Jan 27, 1969 • Allen Klein meets with John Lennon

Jan 28, 1969 • Allen Klein meets with The Beatles

Feb 01, 1969 • Allen Klein, John Eastman, and The Beatles discuss about NEMS

January to February 17, 1969 • NEMS / Nemperor is sold to Triumph Investment Trust

February 21 to August 1969 • The Beatles fight for NEMS / Nemperor

March 1969 • Dick James sells his Northern Songs shares to ATV

Mar 21, 1969 • Allen Klein becomes business manager of Apple

April - May 1969 • The Beatles and ATV fight for the control of Northern Songs

September to November 1969 • ATV finalizes its acquisition of Northern Songs

In the fall of 1968, The Beatles, at the initiative of Paul McCartney, started to look for a new manager for Apple. But quite quickly, Paul was convinced that Lee Eastman, father of Linda Eastman and his future father-in-law, should be put in control of The Beatles’ financial affairs. The other Beatles were not comfortable with the idea that Paul’s future father-in-law would run Apple, but in January 1969, they agreed to have Lee Eastman and his son John as business advisors for a short while.

John Eastman then came up with the idea of buying Nemperor Holdings (the new name of Brian Epstein’s former company NEMS Enterprises). Nemperor Holdings was the entity receiving all The Beatles’ earnings and passing them to Apple after a 25% deduction. Since Brian’s death in August 1967, NEMS / Nemperor was owned by Queenie Epstein, Brian’s mother, and Clive Epstein, Brian’s brother; and led by Clive. The Beatles owned 10% of NEMS at this stage.

Ownership of NEMS / Nemperor early 1969:

| Queenie Epstein | 70% |

| Clive Epstein | 20% |

| The Beatles (which company?) | 10% |

Late 1967, Clive Epstein had received and refused an offer to sell NEMS to Triumph Investment Trust, headed up by merchant banker Leonard Richenberg. A year later, Leonard Richenberg tried again and Clive Epstein was ready to accept the offer.

Some aspects of Nems were difficult to put a net value on, because nobody knew at the time just how large a record royalty E.M.I. was due to pay Nems. Nems was a cash commpany with a large tax liability. There was little doubt that the Epsteins were going to be slaughtered by death duties.

I knew there was an element of risk involved. There was a drug charge pending against one of the Beatles and their own company, Apple, didn’t seem too prosperous at the time. My offer to Epstein was devised to circumvent the death duty liability, and, in effect, it was two offers. I offered to buy Mrs. Epstein’s seventy percent share in Nems outright for 620,000 pounds. I agreed to pay Clive Epstein 420,000 pounds, provided the royalties to come to Nems were not less than 350,000 pounds for two years. If there were no royalties, he would get 150,000 pounds for his twenty percent stake in the company.

Leonard Richenberg – From “Apple to the Core: The Unmaking of the Beatles” by Peter McCabe and Robert D. Schonfeld (1972)

However, Queenie and Clive Epstein felt they had a moral obligation to let The Beatles know about this opportunity for them, and, for now, rejected the offer from Triumph.

John Eastman’s plan was to buy NEMS for one million pounds. Sir Joseph Lockwood, the chairman of EMI, had agreed to advance the entire sum against future royalty earnings.

I saw Clive Epstein immediately. I told him, ‘Look, you can’t get the money out of the company to pay estate taxes, so why don’t we buy NEMS and you’ll get the money as a capital gain. Forget the twenty-five per cent [NEMS’ entitlement of Beatles’ royalties]. What’s the company worth? Eight-hundred-thousand pounds? Nine-hundred-thousand pounds? Forget it, we won’t quibble, we’ll give you a million!

John Eastman – From “Apple to the Core: The Unmaking of the Beatles” by Peter McCabe and Robert D. Schonfeld (1972)

On January 27, 1969, John Lennon made controversial American businessman Allen Klein his personal adviser.

The first meeting between Klein and the four Beatles was on January 28, and the potential acquisition of Nemperor / NEMS was discussed. The following is taken from Allen Klein’s affidavit, read out in the High Court, London in early 1971, during the hearing of Paul McCartney’s lawsuit to dissolve The Beatles’ partnership:

On 28th January 1969 at 3 Saville Row London W1 at about 9 pm I met Mr Lennon, the Plaintiff [Paul McCartney], Richard Starkey (Ringo Starr) and George Harrison (the other Beatles) and had a general discussion about the proposed purchase of NEMS. I informed them that for my part I could not recommend Mr Lennon to proceed with the purchase while (as was the fact) the relevant information about the position of The Beatles (and their companies) themselves remained to be ascertained. The Plaintiff said that the proposal was strongly recommended by John Eastman and he (the Plaintiff) was pressing it. I therefore suggested that there was no point in debating the matter in the abscence of John Eastman and it was agreed that we have another meeting on Saturday 1st February, with John Eastman present.

Allen Klein – From The Beatles: Allen Klein’s Affidavit: Rockmine On-Line

They reconvened on February 1 to discuss the acquisition of NEMS in further detail, with John Eastman in the room. From Allen Klein’s affidavit read in February 1971:

The purpose of the meeting on 1st February was, as I have indicated, primarily to discuss the proposed acquisition of NEMS. John Eastman was proposing this on two grounds: first, that it was a good deal in any case, because the company was available for £1 million and in itself was worth £1 million, and that the money in the Company could be used to pay for the purchase. (I did not know at that time that there was anything unlawful in such an arrangement, but I did know that in order to have £1 million to spend you have to earn a considerably larger sum before tax, and if the advance of £1 million from EMI to fund the purchase was going to have to be paid back out of royalty income, I explained that earnings of at least £2 million would be required.) The second ground on which Eastman recommended the purchase was that NEMS owned a block of 237,000 shares in Northern Songs Limited (“Northern Songs”). Northern Songs was a Public Company quoted on The Stock Exchange, London. Its principal assets were rights, derived from Maclen (Music) Limited. (“maclen”), in the compostitions of Mr Lennon and the Plaintiff, including future compositions until February 1973.

At this meeting (1st February 1969) the Plaintiff [Paul McCartney] introduced the subject of Northern Songs and said that he wanted The Beatles to own it. I suggested that it was something that we could look at later. As regards the large holding of NEMS in Northern Songs, I said that at that time I did not feel that the existence of the holding was a sufficient reason to pay £1 million out of a company (Apple) when we did not know what its financial position was. It was agreed that the idea of buying the share capital of NEMS and the possible acquisition of Northern Songs should be shelved until the financial position of The Beatles’ companies had been ascertained and it was also agreed by all four Beatles that I should be persuaded to look into the financial position of those companies. […]

Allen Klein – From The Beatles: Allen Klein’s Affidavit: Rockmine On-Line

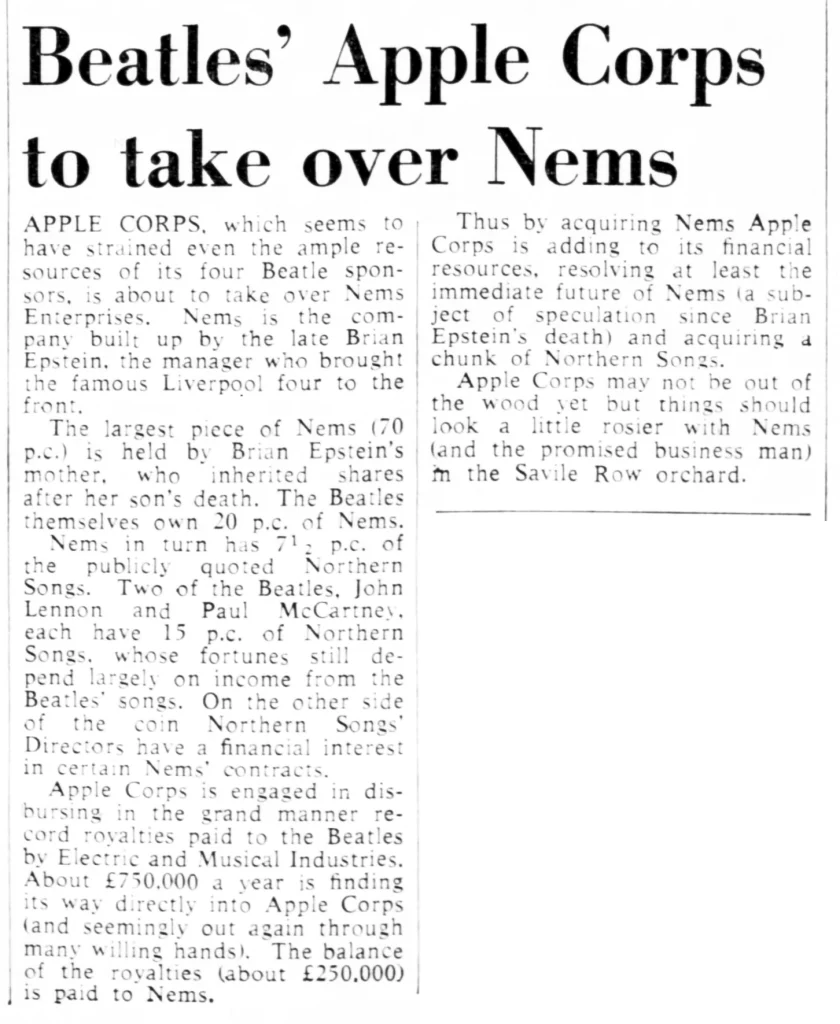

The idea of acquiring NEMS, how hypothetical it could be at this stage, was however revealed in the press.

Apple Corps, the Beatle enterprise, is to take over Nems Enterprises, the company built up by the foursome’s late manager, Brian Epstein. The largest holding in Nems is the 70% owned by Epstein’s mother, who inherited shares alter his death, and the Beatles themselves have 20%. There is further interlinking represented by a 7.2% Nems stake in the publicly quoted Northern Songs, in which John Lennon and Paul McCartney have 15% each, and Northern Songs directors have a financial interest in some Nems contracts. Rumors that Apple has been experiencing fiscal strain were substantiated recently by comments attributed to Lennon to the effect that if the company’s expenditure continued at its present level, it would be bankrupt within six months. Apple publicity director Derek Taylor remarked in a BBC radio interview that it seemed the company had too many people on its payroll and was trying to help too many causes and projects financially. Lennon approached Lord Beeching, a noted figure in British industry and former chief of British Rail, for business guidance and assistance for Apple last fall, but received a polite refusal. Another top businessman, at present anonymous, is said to be taking over the administrative reins of the company to organise it on a sounder footing. It is estimated that Apple receives about £750,000 annually in Beatle record royalties, while a further 250,000 goes to Nems. These amounts will obviously swell when proceeds from the massive sales of the foursome’s current double album start to flow. By acquiring Nems, Apple will strengthen its own financial health and also obtain a slice of Northern Songs.

From CashBox Magazine – February 2, 1969

The Beatles, Allen Klein, and John Eastman met again on February 3. And in this evening, Allen Klein met with Clive Epstein, and Clive Epstein agreed to do nothing for three weeks, the time needed for Allen Klein to examine The Beatles’ financial situation in detail.

On the evening of the same day, 3rd February 1969, I met Clive Epstein and Mr Pinsker at the Dorchester Hotel to discuss with them the possible purchase by Apple of the share capital of NEMS. Clive Epstein was then Managing Director of NEMS and Mr Pinsker’s firm, Bryce Hammer & Co, acted as accountants for both NEMS and The Beatles. I asked Clive Epstein if he would be willing to wait and defer a decision with regard to his disposal of NEMS for about three weeks until I had had an opportunity to assess the financial position of The Beatles and their companies. Clive Epstein agreed to defer a decision for at least three weeks. The following day I left for New York to begin an investigation into the three main sources of The Beatles’ income as a verification of their financial position. The three sources were United Artists Corporation, the Company which handled The Beatles’ films (“United Artists”), General Artists Corporation, which handled their American tours (“G.A.C.”) and EMI and its United States subsidiary, Capitol Records Inc. Formal letters of direction were issued by The Beatles to enable me to obtain the requisite information. There is now produced and shown to me marked “A.K.5” a bundle comprising copies of these letters and other letters referred to below.

Allen Klein – From The Beatles: Allen Klein’s Affidavit: Rockmine On-Line

Nothing further has occurred in the matter of the merger between Nems Enterprises and the Beatles’ Apple Corps organization since the initial reports that Apple would take over Nems. This has since been denied, but considerably closer links between the two companies appear to be inevitable. The late Brian Epstein’s brother Clive, who is Nems chairman, has been engaged in discussions with Apple on the subject. He owns 20% of the Nems shares, and his mother holds 70%, mostly inherited upon her other son’s death, a legacy which is believed to have been complicated by considerable death duties to be paid. There is still no indication about the identity of the businessman who is supposed to be joining Apple to organize it on a sound business basis, but one name being speculated on is Nat Weiss, Brian Epstein’s American associate. Meanwhile a rift between George Harrison, recently fined in a French court action for a Riviera assault on a press photographer, and the other Beatles is reported as amicably healed.

From CashBox Magazine – February 8, 1969

On February 14, 1969, John Eastman inexplicably wrote to Clive Epstein the following letter (even if he later said that he wrote it at Allen Klein’s request, with Klein denying it):

As you know, Mr Allen Klein is doing an audit of The Beatles affairs vis-à-vis NEMS and Nemperor Holdings Ltd. When this has been completed I suggest we meet to discuss the results of Mr Klein’s audit as well as the propriety of the negotiations surrounding the nine-year agreement between EMI, The Beatles and NEMS.

John Eastman – From “The Beatles Diary Volume 1: The Beatles Years” by Barry Miles

The use of the words “propriety of the negotiations” shocked Clive Epstein, who considered the words were insulting towards his late brother. He immediately replied by letter on February 15:

Before any meeting takes place, please be good enough to let me know precisely what you mean by the phrase ‘the propriety of the negotiations surrounding the nine-year agreement between EMI, The Beatles and NEMS’.

Clive Epstein – From “The Beatles Diary Volume 1: The Beatles Years” by Barry Miles

Feeling he would be dragged into difficulties with The Beatles, John Eastman, and Allen Klein, Clive Epstein decided to reopen the negotiations with Triumph Investment Trust and Leonard Richenberg.

On February 17, Triumph acquired 70% of the shares of NEMS and its holding Nemperor Holdings for £750,000 (the shares owned by Queenie Epstein).

Eastman spent a week negotiating for Nems on the basis of the loan EMI was prepared to make The Beatles. But he loaded the offer with so many conditions and warranties that he ended up talking himself out of the deal. In my opinion, he was a little too young to be negotiating at that level.

Clive Epstein – From “Apple to the Core: The Unmaking of the Beatles” by Peter McCabe and Robert D. Schonfeld (1972)

I considered what Eastman was advocating [buying Nems] to be stupid. The last thing the boys should have done was buy income. I gathered that Klein hadn’t wanted the deal to go through. I still think it was a shame that the Beatles were involved with either Eastman or Klein because I think we could have harnessed their ability to do what the public wanted.

Anyway, on February 17, we were owners of seventy percenty of Nemperor Holdings. Epstein was a little difficult to deal with, but I think he trusted me. In many ways he’s like his brother was, good bookkeeper yes, financier no. Of course, when we did the deal there were a lot of eyebrows raised in the City. Merchant bankers buying into show business?

Lenoard Richenberg – From “Apple to the Core: The Unmaking of the Beatles” by Peter McCabe and Robert D. Schonfeld (1972)

It’s fair to say that had we got Nems, a lot of our later financial problems would never have occurred. It cost The Beatles a lot more to free themselves from Triumph later. You could say the deal was crucial.

John Eastman kept wantin’ to attach these tax warranties. I kept sayin’ to him, ‘Shurrup, will yer,’ ’cause I could see the whole deal was getting screwed up by this and that Clive didn’t like the idea. If you ask me, Lee Eastman was stupid to send his son over. You tell me, would you send your son to do business with John Lennon?

Neil Aspinall, Apple’s managing director – From “Apple to the Core: The Unmaking of the Beatles” by Peter McCabe and Robert D. Schonfeld (1972)

[John] Eastman seemed to think that they were going to be angry with Klein. He flew to London thinking Klein would be ready to give up. It was like expecting Hitler to be scared off by the Liechtenstein Army. In the end, he was hoping Klein would be prepared to compromise, but Klein wasn’t prepared to share out control if he could get it all. I warned Eastman that if Paul had threatened to leave then, it might still have stopped Klein. But between them all, they were like gravediggers feeding on the body of the dying.

Nat Weiss – From “Apple to the Core: The Unmaking of the Beatles” by Peter McCabe and Robert D. Schonfeld (1972)

Ownership of Nemperor / NEMS after Triumph acquisition:

| Triumph Investment Trust Limited | 70% |

| Clive Epstein | 20% |

| The Beatles (which company?) | 10% |

(In a second step and before April 1969, Triumph would acquire the 20% shares of Clive Epstein and therefore would own 90% of the Nemperor shares)

Triumph Controls 70% Of Nemperor

LONDON — Triumph Investment Trust, a diversified corporation here has purchased 70% of the holdings in Nemperor Holding Ltd., parent firm of Nems Enterprise, the agency formed by the Beatles and the late Brian Epstein. Deal, for a reported $1.6 million, was made with Epstein’s mother, Queenie Epstein. Clive Epstein, brother of Brian, owns 20% of Nemperor and is chairman ot the company. The Beatles hold 10% of the company.

From CashBox Magazine – March 15, 1969

Triumph Investment Trust, a merchant banking and hire purchase finance group, has acquired a 70% stake in Nemperor Holdings, the parent company of the late Brian Epstein’s interests in the Beatles and Nems Enterprises, with management interests in about 350 artists. An exchange of equity to the tune of £1 million obtained the shares in Nems inherited by Queenie Epstein from her son Brian. Her other son, Nemperor chairman Clive Epstein, continues in that position with a 20% stake in the company and the remaining 10% belongs to the Beatles through their Nems interests. Triumph, which invested £50,000 in Titan International Films last year, will also benefit from the thriving Northern Songs, publishers of the Beatle copyrights, by its Nemperor acquisition.

From CashBox Magazine – March 15, 1969

In the following weeks and months, The Beatles, Allen Klein and the Eastmans would fight back, as it was unacceptable for them that Triumph would own 25% of all The Beatles’ earnings.

The Beatles Diary Volume 1: The Beatles Years

"With greatly expanded text, this is the most revealing and frank personal 30-year chronicle of the group ever written. Insider Barry Miles covers the Beatles story from childhood to the break-up of the group."

We owe a lot to Barry Miles for the creation of those pages, but you really have to buy this book to get all the details - a day to day chronology of what happened to the four Beatles during the Beatles years!

Notice any inaccuracies on this page? Have additional insights or ideas for new content? Or just want to share your thoughts? We value your feedback! Please use the form below to get in touch with us.