Wednesday, February 24, 1971

The trial for the dissolution of The Beatles’ contractual partnership – Day 4

Last updated on April 27, 2022

Wednesday, February 24, 1971

Last updated on April 27, 2022

Article Feb 23, 1971 • The trial for the dissolution of The Beatles’ contractual partnership - Day 3

Session Feb 23, 1971 • Recording "The Great Cock And Seagull Race"

Article Feb 24, 1971 • The trial for the dissolution of The Beatles’ contractual partnership – Day 4

Article Feb 25, 1971 • "Another Day" broadcast on Top Of The Pops

Article Feb 25, 1971 • The trial for the dissolution of The Beatles’ contractual partnership – Day 5

Dec 31, 1970 • Paul McCartney files a lawsuit against the other three Beatles

Feb 19, 1971 • The trial for the dissolution of The Beatles' contractual partnership - Day 1

Feb 22, 1971 • The trial for the dissolution of The Beatles’ contractual partnership – Day 2

Feb 23, 1971 • The trial for the dissolution of The Beatles’ contractual partnership - Day 3

Feb 24, 1971 • The trial for the dissolution of The Beatles’ contractual partnership – Day 4

Feb 26, 1971 • The trial for the dissolution of The Beatles’ contractual partnership – Day 6

Mar 12, 1971 • The trial for the dissolution of The Beatles' contractual partnership - Decision

Apr 25, 1971 • John Lennon, George Harrison, Ringo Starr decide not to appeal High Court order

On the fourth day of the Court Case for the dissolution of The Beatles’ contractual partnership, two affidavits from Allen Klein were read:

I, ALLEN KLEIN of 3101 Palisades Avenue, Riverdale, New York, U.S.A., record manufacturer, music publisher and entertainment business manager, MAKE OATH and say as follows:-

1. I have been shown and have read, copies of the several Affidavits (together with the exhibits thereto) sworn in this action by the Plaintiff, Martin Robert Lampard, Geoffrey Maitland-Smith, Michael Daniel Boohan and Raymond Anstis, and filed in support of the Plaintiff’s application by notice of motion, given for the 19th January 1971, for certain interlocutory relief.

2. The Plaintiff, in the evidence filed in support of his application, attacks my commercial integrity in general, and in my dealings with and for the group of musicians, consisting of the Plaintiff and the three individual Defendants, known as “The Beatles” in particular; and the Plaintiff alleges that the assets of The Beatles partnership constituted by the Deed of Partnership dated 19th April 1967 mentioned in the Plaintiff’s Affidavit are now in jeopardy. I am, of course, concerned to answer these attacks, and to rebut this allegation. For these purposes I am advised, and I accept, that it is necessary for me to set out, in this Affidavit, a summary of my commercial history and of my dealings with and for The Beatles; to show that (as is the case) The Beatles have not been prejudiced by these dealings but have, on the contrary, greatly benefited as a result of them; and to demonstrate that the assets of The Beatles partnership are not in any sense now in jeopardy.

3. I was born on 18th December 1931. In 1956 I graduated in Accountancy from Upsala College, East Orange, New Jersey, U.S.A. Prior to my graduation and for some time thereafter I worked for various firms as an accounting clerk, particularly in relation to audits of record companies. In the middle of 1957, I started my own business as a specialised accountant providing this type of service. My business was originally in the form of a partnership with my wife in the name Allen Klein & Co. (later, in 1965, incorporated as Allen Klein & Co., Inc.). Originally, I was rendering audit services to artists but, by about 1960, I had moved into the field of business management for recording artists and was beginning to negotiate contracts on their behalf either with record companies or music publishers. In 1964 I did my first deal for an English Artist.

4. I turn now to deal with the general attacks made on my commercial integrity. I will first mention Cameo-Parkway Records Inc. (“Cameo-Parkway”). In July 1967 I acquired a controlling interest in this corporation, which carried on the business of the manufacture and distribution of gramophone records. At this time Cameo-Parkway was listed and dealt in on the American Stock Exchange. Following my acquisition, the price of the stock of Cameo-Parkway rose considerably. Two of the press cuttings in Exhibit “M.L.2” to the Affidavit of Martin Lampard sworn on 31st December 1970, refer to an action brought against Cameo-Parkway and others by Lucarelli Enterprises Inc. There is now produced and shown to me marked “A.K.1” a true copy of an endorsement setting out the decision of the United States District Judge dismissing the complaint on the grounds that it shows no claim against any of the Defendants, of whom I was one.

5. In the same exhibit, “M.L.2”, reference is made to the delisting of the stock of Cameo-Parkway. There is now produced and shown to me marked “A.K.2” a bundle comprising true copies of official press statements issued by the United States Securities and Exchange Commission (“the S.E.C.”) on 23rd February 1968 and 9th September 1968 stating the decision, first to suspend exchange and over-the-counter trading in Cameo-Parkway stock and subsequently to permit the resumption of over-the-counter trading. The bundle also includes the official orders made and a letter from the American Stock Exchange to my Attorneys dated 12th August 1968 which conveniently summarise the grounds on which delisting was recommended. These grounds were:-

(a) That Cameo-Parkway had reported losses for the past 3 fiscal years ended 30th June 1967 (all being periods before I became interested in the company); and

(b) That the combined assets of Cameo-Parkway and my company, amounting in total to approximately $1 million did not meet the requirements of the Exchange in the case of transactions which I understand are known in England as “reverse takeovers”.6. Since it has been suggested that the suspension and delisting of the stock is an indication of a lack of commercial integrity on my part, I stress that there is no allegation in the documents issued by the S.E.C. or the American Stock Exchange of any dishonest or improper conduct on my part in relation to either of these companies. Indeed, the delsiting was a serious possibility at the outset of my Cameo-Parkway purchase and there was included in the contract for purchase a provision which enabled me to rescind the contract if delisting took place. I had made a public commitment to transfer the assets of my private company to Cameo-Parkway, and I thought it wrong in these circumstances to excercise my right to rescind the contract.

7. On 16th September 1968 a special meeting of the stockholders of Cameo-Parkway approved the acquisition by Cameo-Parkway of the assets and liabilities of Allen Klein & Co.,Inc. In this connection there is now produced and shown to me marked “A.K.3” the proxy statement which was issued by Cameo-Parkway prior to such meeting.

8. In February 1969, the name of Cameo-Parkway was changed to ABKCO Industries Inc. (“ABKCO”). I am the President and Director of ABKCO and, in so far as it may be necessary, I am authorised to make this Affidavit on its behalf.

9. Among other matters mentioned in Mr. Lampard’s press cuttings is the bringing of charges against me in connection with U.S. tax offences. The facts about this (disclosed in the proxy statement referred to in paragraph 7 above) are as follows. In January 1966 an information was filed by the U.S. Attorney alleging the misdemeanour of failing to file returns relating to the withholding of employee’s taxes and Federal Insurance Contribution Act taxes on a quarterly basis for the last quarter of 1959, three quarters of 1960, for the whole of 1961 and the first two quarters of 1962 (that is to say, a seperate allegation in respect of each quarter, totalling ten in all). No allegation was made of failure to pay any tax. The taxes relating to those quarteres have been paid. The information was laid against me in my capacity as the principal partner in the firm of Allen Klein & Co. (which at the material time had not yet been incorporated). The duty of filing these returns had been delegated by me to a member of my staff. On 30th January 1971 the jury found me guilty of the ten charges but the Judge has given leave for formal motions, with supporting papers, to be made and pending these motions being dealt with, no sentence has been imposed. The effect of these motions, if succesful, will be similar to an appeal.

10. In December 1968, I read in the press a statement, attributed to John Lennon, to the effect that if The Beatles continued to spend money at the rate at which they were doing “they would be broke in 6 months”. The following month (January 1969) I telephoned Mr. Lennon from the United States and arranged to meet him in London. This meeting took place at the Dorchester Hotel on 27th January 1969. At that time The Beatles and their company, Apple Corps Limited (“Apple”) had issued a general retainer to one John Eastman to negotiate contracts for them throughout the world. Although that retainer was terminable at any time, Mr. Lennon told me that this was the arrangement and he only asked me at this stage to look after the personal affairs of himself and his wife.

11. Since I was to look after Mr. Lennon’s affairs one matter of immediate urgency was the proposed acquisition by Apple, then under consideration, of Nemperor Holdings Limited, previously called NEMS Enterprises Limited (“NEMS”). I arranged to meet the other three Beatles with Mr. Lennon the following evening. NEMS was the company owned as to 90% by the estate of Brian Epstein (The Beatles’ former Manager) or his family interests, while each of The Beatles individually owned a 21/2% interest. NEMS had acted as the management company for The Beatles from 1962 to about 1967. It and its associated companies held continuing interests in perpetuity in contracts entered into by The Beatles and in the products of their services throughout this period. Some of these rights were of great continuing value, notwithstanding that the management agreement had come to an end. In particular there was a recording agreement dated 26th January 1967 between The Beatles and Electrical & Musical Industries Limited (“EMI”) which did not expire until 1967 and in which NEMS had a 25% interest. At my first meeting with Mr. Lennon mentioned above, he told me that John Eastman had proposed to The Beatles that they should purchase the Epstein interests in NEMS and that the deal was about to be put through finance having been arranged through EMI by means of an advance of £ 1 million against future royalties.

12. On 28th January 1969 at 3 Saville Row London W.1 at about 9 p.m. I met Mr. Lennon, the Plaintiff, Richard Starkey (Ringo Starr) and George Harrison (the other Beatles) and had a general discussion about the proposed purchase of NEMS. I informed them that for my part I could not recommend Mr. Lennon to proceed with the purchase while (as was the fact) the relevant information about the position of The Beatles (and their companies) themselves remained to be ascertained. The Plaintiff said that the proposal was strongly recommended by John Eastman and he (the Plaintiff) was pressing it. I therefore suggested that there was no point in debating the matter in the abscence of John Eastman and it was agreed that we have another meeting on Saturday 1st February, with John Eastman present.

13. During the meeting on 28th January I said that I was going to make enquiries into Mr. Lennon’s financial position. Mr. Starkey and Mr. Harrison asked me to do the same for them. (At this stage the Plaintiff had left the meeting) I spent the remainder of that week largely in the offices of Bryce Hammer & Co., chartered accountants, (who were The Beatles’ personal accountants) with Mr. Harry Pinsker, a partner in that firm, obtaining the information that I required. By the end of the week I had a reasonable amount of information about the personal position of The Beatles but, as I had not had time to make a full investigation into the affairs of their companies, I was not really in a position to assess their true financial position overall.

14. On Saturday 1st February the meeting arranged for that date, with John Eastman present as well, took place as arranged at Apple’s headquarters, 3 Saville Row, London W.1.

15. The purpose of the meeting on 1st February was, as I have indicated, primarily to discuss the proposed acquisition of NEMS. John Eastman was proposing this on two grounds: first, that it was a good deal in any case, because the company was available for £1 million and in itself was worth £ 1 million, and that the money in the Company could be used to pay for the purchase. (I did not know at that time that there was anything unlawful in such an arrangement, but I did know that in order to have £ 1 million to spend you have to earn a considerably larger sum before tax, and if the advance of £ 1 million from EMI to fund the purchase was going to have to be paid back out of royalty income, I explained that earnings of at least £ 2 million would be required.) The second ground on which Eastman recommended the purchase was that NEMS owned a block of 237,000 shares in Northern Songs Limited (“Northern Songs”). Northern Songs was a Public Company quoted on The Stock Exchange, London. Its principal assets were rights, derived from Maclen (Music) Limited. (“maclen”), in the compostitions of Mr. Lennon and the Plaintiff, including future compositions until February 1973.

16. At this meeting (1st February 1969) the Plaintiff introduced the subject of Northern Songs and said that he wanted The Beatles to own it. I suggested that it was something that we could look at later. As regards the large holding of NEMS in Northern Songs, I said that at that time I did not feel that the existence of the holding was a sufficient reason to pay £ 1 million out of a company (Apple) when we did not know what its financial position was. It was agreed that the idea of buying the share capital of NEMS and the possible acquisition of Northern Songs should be shelved until the financial position of The Beatles’ companies had been ascertained and it was also agreed by all four Beatles that I should be persuaded to look into the financial position of those companies.

17. At this stage John Eastman launched an attack on my personal integrity, producing a copy of the Cameo-Parkway Proxy Statement mentioned above and clippings from newspapers. He alleged that I had a bad reputation in general and raised questions about Cameo-parkway in particular. I pointed out that the Cameo-Parkway Proxy Statement made, in accordance with the stringent requirements of United States law and practice with respect to securities transactions, a full and complete disclosure of the “warts” of Cameo-Parkway’s career and was there for all to see. I also invited him to make specific charges or criticisms which would enable me to answer them, but he did not do so. In any case I think that my answers must have satisfied The Beatles. I suggested that the position of John Eastman should be that of legal adviser to The Beatles and all their companies. He rejected this on the ground that he did more than an English lawyer normally does. the meeting broke up and another meeting was arranged for the following Monday 3rd February 1969, again at Saville Row.

18. On the morning of 3rd February 1969, I went to 3 Saville Row and saw the four Beatles, John Eastman and a few principal staff members of Apple, who were informed that my company (then still called Cameo-Parkway) had been appointed to look into the affairs of The Beatles and all their Companies. At this meeting John Eastman agreed that he would, after all, act as legal adviser to The Beatles and all their companies.

19. Apple issued two press announcements, one relating to my Company’s appointment and a separate one relating to the appointment as lawyers of John Eastman’s firm, Eastman & Eastman. Cameo-Parkway also issued a press announcement of its own, a copy of which is now produced and shown to me marked “A.K.4”.

20. On the evening of the same day, 3rd February 1969, I met Clive Epstein and Mr. Pinsker at the Dorchester Hotel to discuss with them the possible purchase by Apple of the share capital of NEMS. Clive Epstein was then Managing Director of NEMS and Mr. Pinsker’s firm, Bryce Hammer & Co., acted as accountants for both NEMS and The Beatles. I asked Clive Epstein if he would be willing to wait and defer a decision with regard to his disposal of NEMS for about three weeks until I had had an opportunity to assess the financial position of The Beatles and their companies. Clive Epstein agreed to defer a decision for at least three weeks. The following day I left for New York to begin an investigation into the three main sources of The Beatles’ income as a verification of their financial position. The three sources were United Artists Corporation, the Company which handled The Beatles’ films (“United Artists”), General Artists Corporation, which handled their American tours (“G.A.C.”) and EMI and its United States subsidiary, Capitol Records Inc. Formal letters of direction were issued by The Beatles to enable me to obtain the requisite information. There is now produced and shown to me marked “A.K.5” a bundle comprising copies of these letters and other letters referred to below.

21. I took with me to New York all the Apple files and correspondence relating to contracts and financial matters, so far as I could obtain them. My objective was to find out from the prime sources of The Beatles income exactly what gross income had been generated and then trace it back and reconcile it with their books. This I did for all practical purposes, by 12th March 1969 (save for Maclen). I obtained, while in the United States, particulars from United Artists and G.A.C. of the gross income attributable to the services which they handled. In the case of G.A.C. this also involved obtaining particulars of expenditure which had been debited against the income. I also went through many contracts and much correspondence and tried to establish a basis on which I could determine what rights had been granted with respect to the services of The Beatles, how rights devolved from those basic grants to subsidiary parties and what income had been generated. The files and information on which I had to work were inadequate.

22. I had not completed this aspect of my task to my satisfaction when I was called to London by an urgent telephone call on Friday 21st February 1969 from Mr. Neil Aspinall, who was then Managing Director of Apple. He told me that Clive Epstein had visited him with a Mr. Leonard Richenberg from Triumph Investment Corporation who had told him that Triumph Investment Trust Limited (“Triumph”) a subsidiary of Triumph Investment Corporation, had purchased either all the shares or a controlling interest in NEMS. I was shocked and dismayed at this turn of events and I immediately telephoned Mr. Pinsker who told me that he had not been aware of…

[The following page (page 8) of the document is missing. Transcript continues from the page after that.]

…being brought further up to date, namely 28th February 1969). This document, which resulted from the reconstruction mentioned in this paragraph, showed that as matters then stood the current liabilities of the companies exceeded their current assets.26. During the period leading up to the production of this document and also after it was produced I had many meetings with The Beatles, and I made it clear to them that their financial position was perilous. I took the view that my first task was to help them to generate enough income to alleviate this situation. The largest potential source of income was recording royalties and I wanted to negotiate a new recording arrangement with EMI. Discussions were held with The Beatles and John Eastman as to how EMI should be approached and who should go to a meeting with them. John Eastman wanted to attend, but it was essential that a choice be made as to who should have authority to negotiate, because there was uncertainty in the out-side world as to whether I or John Eastman spoke for The Beatles. It was decided by all four of The Beatles that I alone should go with them and have authority to negotiate. The Plaintiff was anxious for John Eastman to attend, but he went along with the collective decision. (A meeting accordingly took place on 7th May 1969 when there were present all of The Beatles apart from Mr. Starkey (who was working on a film), Yoko Ono (now Mr. Lennon’s wife), myself and three representatives of EMI, namely Sir Joseph Lockwood, Mr. Len Wood, and Mr. Ken East. No conclusion was reached at this meeting, but EMI made it quite clear that they were not prepared to negotiate any new arrangement so long as the NEMS claim was outstanding.

27. I left England on 12th March 1969, having instructed Goodman Myers & Co., to investigate and analyse the expenditure of The Beatles & Co., Apple, Apple Electronics Limited and Apple Publishing Limited on entertainment, travelling, insurance, legal and professional charges and other expenditure. These are now produced and shown to me in a bundle marked “A.K.8” true copies of the reports of Goodman Myers & Co. rendered in pursuance of these instructions.

28. Mr. John Chambers, a former employee of Arthur Young’s who was seconded by them to Apple, already held at that time the position of Chief Financial Officer to Apple and was responsible unti his departure in late August 1969 for the day to day liason with the auditors. It was his job to deal with any requests for financial information which they might have and to supervise and control the Apple accounting system.

29. On the 28th March 1969, I received a telephone call from Apple informing me that Dick James, Managing Director of Northern Songs, had agreed to accept an offer by Associated Television Limited (“A.T.V.”) in respect of his shareholding. I next received a call from Mr. Lennon (who had not been available on 28th March) and subsequently a call from the Plaintiff. Both asked me to return immediately to London and do something to counter the A.T.V. offer.

30. On arriving in London a day or two afterwards I consulted Henry Ansbacher & Co. Limited (“Ansbachers”), Merchant Bankers and in particular Mr. Bruce Ormrod of that firm. He advised that a id could succesfully be made by The Beatles, and that if they joined forces they need only make a partial bid; that is to say, it would only be necessary to bid for say 1 million out of 5 million outstanding shares in Northern Songs because The Beatles and their companies already had approximately 30%.

31. Between that date and 18th April 1969 there was a brief series of meetings with Ansbachers and The Beatles. Shortly before the offer documents were due to be sent out (18th April), Lee Eastman, whom I had not previously met, arrived in London. Lee Eastman was the father and the partner of John Eastman, and the father-in-law of the Plaintiff.

32. The following day I met Lee Eastman at Claridge’s Hotel with The Beatles other than Mr. Starkey.

33. In addition to discussion on the Northern Songs project, Lee Eastman raised a variety of proposals in which he was suggesting that he could assist The Beatles, in particular a closed circuit television (this word unreadable) and the management of Maclen, a music publishing company which controls the songwriting activities of Mr. Lennon and the Plaintiff. He also opposed the Northern Songs acquisition and during the discussion he launched into an emotional tirade against me. I thought it best not to retaliate.

34. On 17th April 1969 there was a long meeting at Apple attended by Mr. Ormrod of Ansbachers, their solicitors, Lee Eastman, Joynson-Hicks & Co. on behalf of Apple and (I think) only three of The Beatles, Mr Starkey being at that time engaged on the film “The Magic Christian”. The purpose of the meeting was to enable Ansbachers to explain in detail the forthcoming offer for Northern Songs, and to review all the facts. Lee Eastman who created another unpleasant scene at this meeting, did not advise the Plaintiff or the others to accept the A.T.V. bid. He was simply advising all of them to hang on. I pointed out that if they did this, they would end up with a minority holding and would be completely at the mercy of A.T.V. This view was supported by Mr. Ormrod. Finally it was agreed by everyone, including Lee Eastman and the Plaintiff, that the preparation of the offer documents should go ahead.

From The Beatles: Allen Klein’s Affidavit: Rockmine On-Line

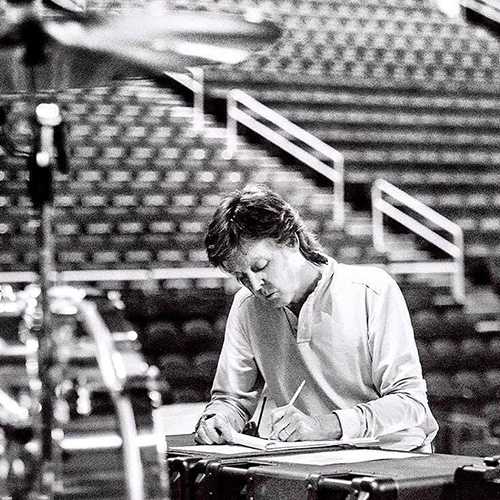

Klein ‘doubled Beatles’ income’ Allen Klein more than doubled the Beatles’ income in the first nine months after he took over as manager in May, 1969, it was claimed in the High Court yesterday, and last year he increased income five-fold. As a result of Mr Klein’s efforts, it was claimed, the Beatles partnership income increased from isso.tjo’ tor tne year ended March 31, 1969. to 1,708,651 in the nine months ended December 31. 1969. In the vear to December 31, 1970, the “income was f 383,509- The figures v, given in written evidenct by an accountant. Mr John Darby, who said Mr Klein had been ” very successful.” Rescued 5Ir Darby’s affidavit was read by Mr Morris Finer, QC, appearing for John Lennon, George Harrison. Ringo Starr, and Apple Corps Ltd. who oppose an application bv Paul McCartney for appointment of a receiver of the group’s business affairs pending trial of his action to have the partnership legally broken up. McCartney has strongly criticised the management of the group’s affairs by Mr Klein. The Beatles hearing, before Mr Justice Stamp, began last Friday and may not now finish this week. On Monday the Judge was told by Mr Finer that -Mr Klein had ” rescued the Beatles from almost total bankruptcy.” Yesterday Mr Finer said Apple Corps was solvent after all tax liabilities, current and nax-able over thp next two years, had been met. The income tax position of the partnership was manifestly capable of being covered from assets in hand and the tax certificates could be bought today. Attacks Mr Finer then read an affidavit bv Mr Klein in which he denied “that the Beatles had been prejudiced by having him as their manager. ” On the contrary, they have greatlv benefited,” – Mr Klein declared. The group’s partnership assets ” are not in any sense ” now in jeopardy, he said. Mr Klein said McCartney had made attacks on his commercial integrity in general, and in his dealings with the Beatles in particular. He “had also claimed that the assets of the Beatles partnership were in jeopardy. Mr Klein said : “I am concerned to answer these attackl and to rebut this allegation.” Mournful solo, page 13

IJNTTL yesterday, Paul McCartney’s mournful and accusing solo from “Abbey Road” could understandably have been playing in the heads of everyone listening to his High Court action against his three fellow Beatles. For three days, a new and glum impression of the Beatles had been waxing in court 16. McCartney alleges that the group is in jeopardy, unable to meet its tax commitments largely thanks to its manager, Mr Allan Klein, and should be wound up. Against this charge, Mr Morris Finer, QC for John, George, and Ringo, has had to mount an inevitably inconclusive holding action, a long wade through provisional accounts and a counter-charge that final papers were hard to produce because of the pre-Klein chaos of Apple Corps organisation. The judge, Mr Justice Stamp, had begun to interrupt with hints that inter-Beatle litigation should be set aside in Favour of “business like” measures to save all four men from ” disaster.” No money, only funny papers JOHN EZARD reports Then, at 1220 p.m. yesterday, Mr Finer announced the solvency of the group with the clenched elan of a man seeking to proclaim in a highly constrained setting the relief of Mafeking by Sergeant Pepper. The Beatle accountants, Arthur Young and Co, had during the case finished a draft statement based on two years’ quarrying in Apple records. The original estimate for the job was a week or so. But as late as the end of last year, investigators were still having to “turn files upside down ” and cope with disappearing and reappearing documents. The verdict was : net bonk value at December 31, 1970, 2,489,000 : contingent tax liabilities, 1,757,000, likely to reduce to a final liability of 1 million. Result : happiness. The Beatles would be in the black by 169,000 even if 1972 tax liabilities were set against present income. And, by the way, no account had been tdken of royalties on McCartney’s album “McCartney ” 489,000 by the end of last year. There was a rustle of pleasure from 40 previously despondent dolly girls and boys and a swift recalculation from eight job – seeking accountants in the bench behind barristers and solicitors. One, an elderly woman, had been wishing she’d applied for the job Mr Klein took 18 months ago. Now she was less convinced of her indispensability. From Mr Finer came a breezy deduction that Beatles’ income was now proven to have increased three times since Mr Klein took over. ” That is why my clients don’t want the man inter fered with and would not have thought Mr McCartney would either,” said Mr Finer. From McCartney’s QC Mr David Hirst, there was no renewal of the friction between the two counsel which had earlier been as acute as that described in evidence between the Beatles. Mr Hirst has hunted Mr Finer through every comma of Mr Finer’s affidavits. He has a habit of finding a page number which Mr Finer is seeking 10 seconds before Mr Finer docs and helpfully reciting a statistic to the judge. Mr Finer then reads out a wholly different statistic. And Mr Hirst asks him to read out something else from the same page verbatim. ” My friend takes a hostile attitude on everything,” said Mr Finer on Tuesday. Mr Hirst still has to complete his own case, which could give Mr Finer his chance. Meanwhile n lunchtime crowd of 200 people w.utcd hopefully in the Strand for a sight of the Beatles, who have not attended court for two days. Mr Klein deep in conversation with junior counsel, walked through them unrecognised and uninterfered with.

The Beatles Diary Volume 2: After The Break-Up 1970-2001

"An updated edition of the best-seller. The story of what happened to the band members, their families and friends after the 1970 break-up is brought right up to date. A fascinating and meticulous piece of Beatles scholarship."

We owe a lot to Keith Badman for the creation of those pages, but you really have to buy this book to get all the details - a day to day chronology of what happened to the four Beatles after the break-up and how their stories intertwined together!

The Beatles - The Dream is Over: Off The Record 2

This edition of the book compiles more outrageous opinions and unrehearsed interviews from the former Beatles and the people who surrounded them. Keith Badman unearths a treasury of Beatles sound bites and points-of-view, taken from the post break up years. Includes insights from Yoko Ono, Linda McCartney, Barbara Bach and many more.

Maccazine - Volume 40, Issue 3 - RAM Part 1 - Timeline

This very special RAM special is the first in a series. This is a Timeline for 1970 – 1971 when McCartney started writing and planning RAM in the summer of 1970 and ending with the release of the first Wings album WILD LIFE in December 1971. [...] One thing I noted when exploring the material inside the deluxe RAM remaster is that the book contains many mistakes. A couple of dates are completely inaccurate and the story is far from complete. For this reason, I started to compile a Timeline for the 1970/1971 period filling the gaps and correcting the mistakes. The result is this Maccazine special. As the Timeline was way too long for one special, we decided to do a double issue (issue 3, 2012 and issue 1, 2013).

Notice any inaccuracies on this page? Have additional insights or ideas for new content? Or just want to share your thoughts? We value your feedback! Please use the form below to get in touch with us.